Hello everyone!

Is our first blog post and what better way to start than by introducing ourselves.

Kaizen Blitz Analytics (KBA) is a technology company born from the union of several years of experience in the real estate rental industry and advanced knowledge of the latest data analytics technologies, machine learning and artificial intelligence.

What do we offer? Very easy!

An AI powered software that can help companies make better and faster risk decisions in the LATAM residential rental market.

The KBA team

We are a team of international expert professionals in the fields of data science, software development, and real estate. We have 3 co-founders (i.e., Borja, Uli, and German) and high-performing employees in the sales, marketing, legal & compliance, data privacy, data architecture and software development spaces.

Let me introduce our 3 co-founders:

Borja

Data Science & Strategy

Borja leads KBA’s data science and strategy efforts. He is originally from Spain where he initiated his professional career, having spent the past 7 years in the U.S. (NYC). He has more than 12 years of Big Four consulting experience in data science, finance and economic analysis in the U.S. and Europe in various sectors including financial services and real estate. Borja has a double bachelor degree in Business Management and Laws by the Universidad Autonoma de Madrid and a Masters of Science in Business Analytics by New York University – Stern. Borja is also a part time lecturer in the analytics masters program of Kaplan Business School in Australia.

Uli

Software development

Uli is based in Germany with more than 10 years of experience in software, Uli leads KBA’s technological development. He has profound expertise in the conceptual design and implementation of analytical software with a focus on ML and optimization. He holds a bachelor’s degree in business from the WHU in Germany as well as master’s degree in business analytics from the New York University. During the past decade has gained substantial expertise consulting various industry clients in the banking, insurance as well as healthcare industry for an American technology corporation as well as a Big Four consulting company in Germany.

Germán

Business Development

Germán leads the localization strategy for KBA in Latam. He is originally from Colombia, where he is leading Rent10, a financial company focused on the property management business. He has more than 8 years of experience in developing solutions focused on technology for the Latam Real State (property management) market. His strong alliances both in Colombia and México supply KBA with high quality data of the tenants’ payment behavior and strategic relationships with big players in the market such as insurance companies and big real state agencies. Germán has a degree in Industrial Engineering by the Universidad de los Andes in Colombia.

The Challenge of the Real Estate Market in Latam

Latam economies tend to be more volatile and vulnerable to changes in the global macroeconomic environment and their currencies show strong fluctuation. The real estate market is equally impacted by these general economic conditions and drivers. A key risk heavily impacted by these drivers is the credit risk of tenants and buyers, which can be dramatically affected by market changes.

In recent years, we have observed a big surge in proptech startups, which are disrupting the Latam real estate market through technology, automation, digitalization and fast-paced decision-making.

All the above factors pose a big threat to all the traditional players in the Latam real estate market, which are under heavy pressure to digitalize, automate, improve their current processes and speed up decision-making to maintain their competitive position.

What KBA Brings to the Table

The path to digitalization, which is equally important to the whole industry (i.e., brokers, insurers, credit bureaus, property managers, owners, etc.) has resulted in a surge of data that can be used to gain a competitive advantage.

With recent developments in computation and technology, Machine Learning is taking over more and more industries by the day. The Real Estate market is at a unique position to leverage the power of ML due to the abundance of data and the complexity of decision making.

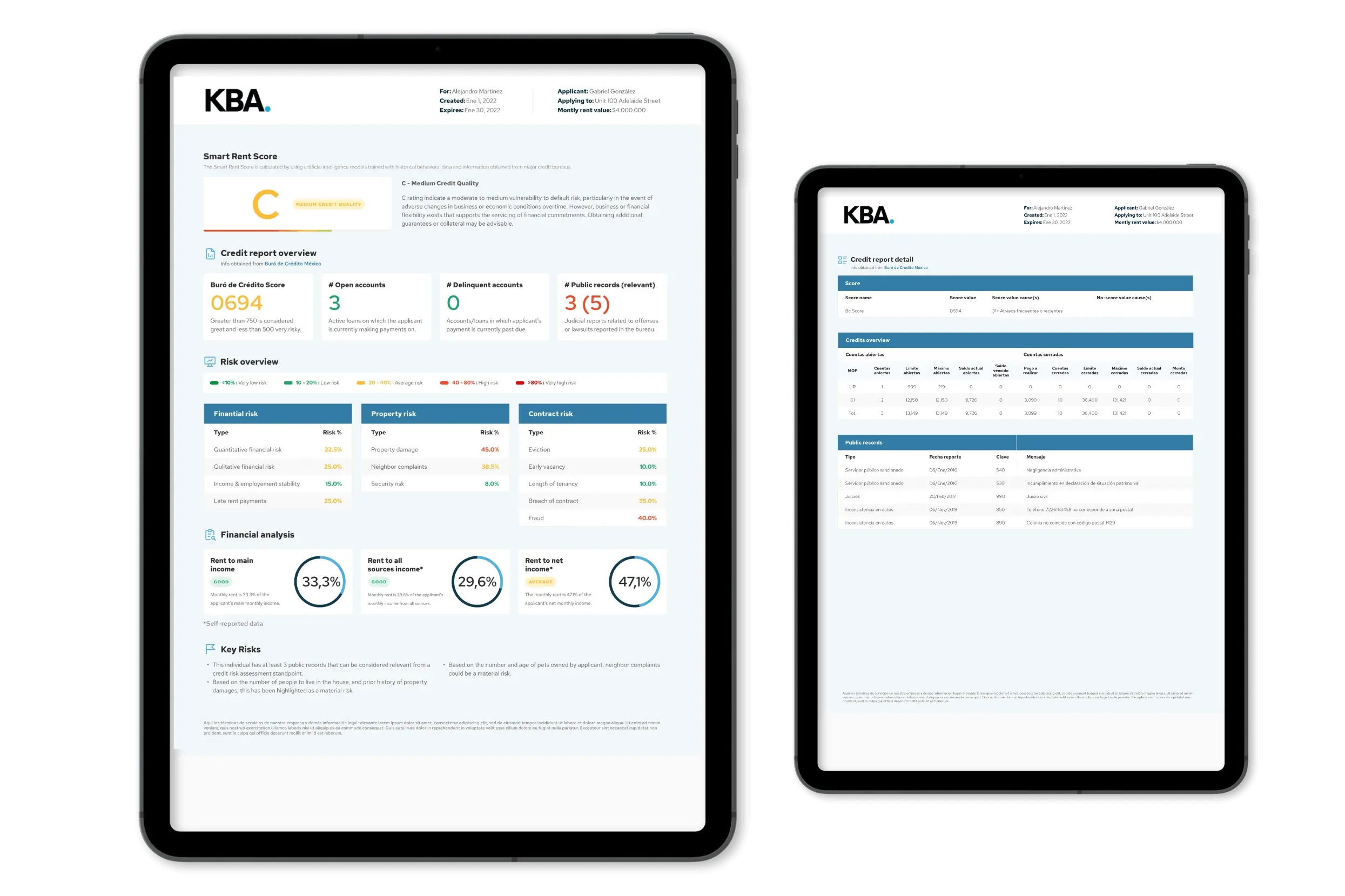

KBA focuses on automated machine learning-power tenant screening solutions, which are offered to real estate actors (i.e., brokers, insurers, owners) to augment their tenant screening efforts. Our ML-powered software and algorithms is bringing massive change to our clients, who are shifting from reviewing a prospective tenant in days to minutes and from using a few simple rules to leveraging thousands of rules and patterns that can be adapted in quasi-real time to changing market conditions.

We provide tenant profiling and risk assessment through our artificial intelligence algorithm called Smart Rent Score (SRS). SmartRentScore (SRS) is the algorithm developed by Kaizen Blitz Analytics (KBA) which uses historical default data from thousands of rent contracts and advanced machine learning technology to augment and empower your risk analysis process by automating your decisions making, maximizing your acceptance rate, minimize your default and provide you with insights to speed up any residual manual review studies.

We can serve all types of clients in the Latin American real estate market, regardless of the stage of technological development.

To showcase our value, we offer free proofs of concept where you can test the power of our algorithms in software on your data and assess the value we can bring to You.

And if you want to be aware of all the tips and useful information for owners and tenants, be sure to read our blog.

Soon we will upload more posts!