Are you planning to rent your apartment but feel insecure about who you are going to rent it to?

Would you like to know the chances that the prospective tenant will pay the rent on time and every month? And, would you also want to be sure that he/she is going to treat your house responsibly and not cause damage to it? Would you like to confirm if he/she has previously been subjected to an eviction or defaulted on his/her rent payments?

The answer is: tenant screening.

What is tenant screening and why do I need it?

Tenant screening provides a landlord information about a prospective renter’s financial and rental history. In this way, the landlord can mitigate possible non-payment of rent or other problems such as property damage. So, tenant selection fees are a small cost to pay considering the amount of revenue and time the landlord could lose if they chose the wrong tenant.

Also, currently, the tenant selection process is slow and subjective, making it unfair and burdensome to prospective tenants and making the entire rental process much more inefficient.

With recent developments in computation and technology, Machine Learning is taking over more and more industries by the day. The Real Estate market is in a unique position to leverage the power of ML due to the abundance of data and the complexity of decision making. With automated tenant screening, you can go from screening your prospective tenant in days to a few seconds.

Can machine learning help with tenant screening?

Yes, machine learning algorithms can be used to help with tenant screening by learning from data of past tenants and being trained to make predictions or decisions based on that data. Once trained, the algorithm could then be used to evaluate new potential tenants and make predictions about their suitability as tenants. This could help landlords automate the tenant screening process and make more accurate decisions.

Indeed, to give you a tiny example of how much technology is impacting our day to day we will admit that this response was generated using an intelligent text generation algorithm called GPT-3.

How can KBA help you with Tenant Screening?

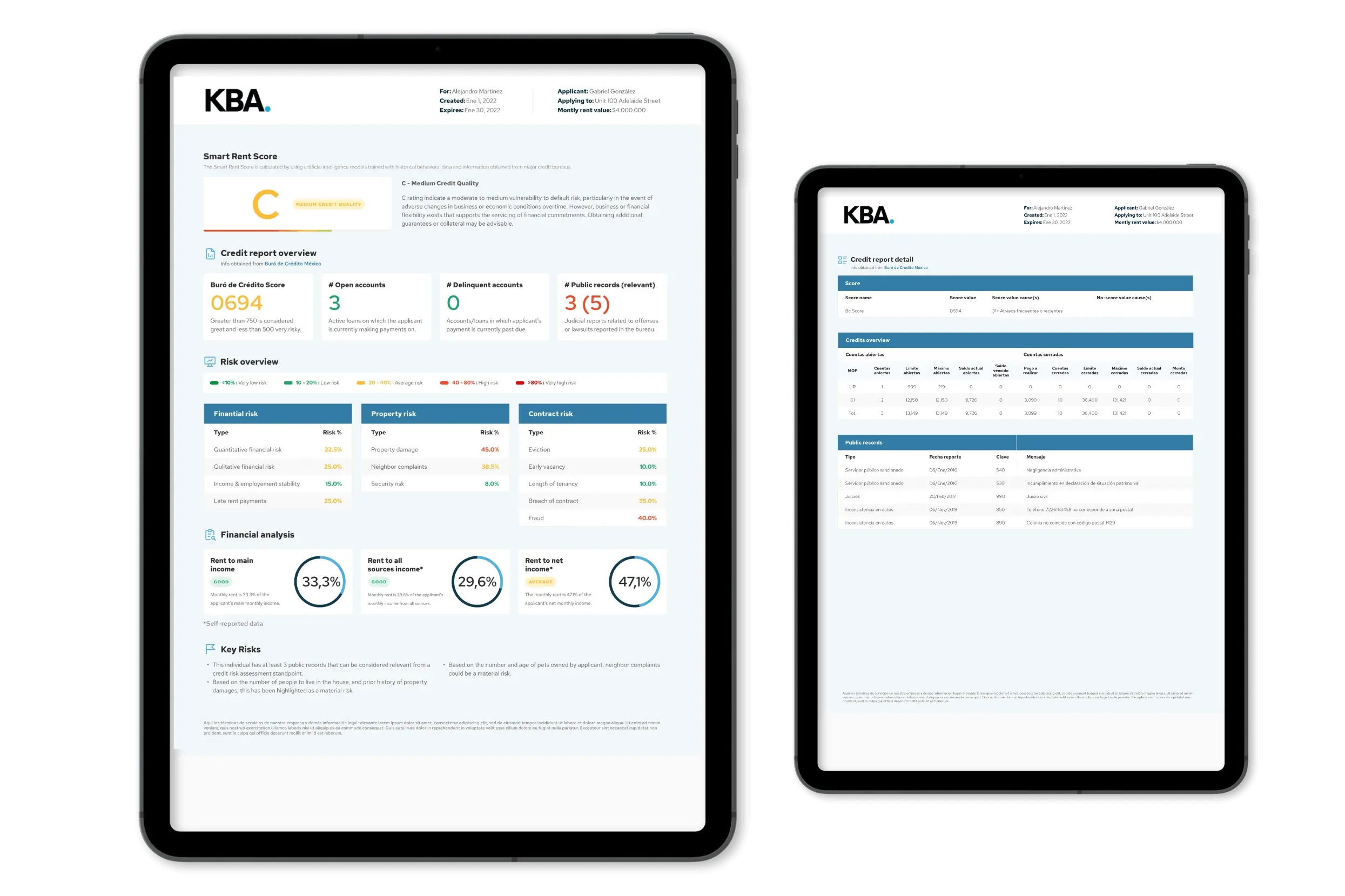

We have developed an AI algorithm called SmartRentScore (SRS) leveraging thousands of rent contracts and advanced machine learning. SRS is transforming how real estate actors make decisions on tenant risk, operate, and grow.

SRS provides our clients with a probability of rent payment default, the main risk drivers for the tenant and a sensitivity analysis of the probability for different levels of rent. We do all this for the applicant / tenant and up to two co-debtors, at no extra charge.

Each review with SRS takes a few seconds and our software solution is already connected and integrated with the main credit bureaus so that you can focus on what matters i.e., growing your business.

We adapt to the needs of our clients and can provide SRS as a standalone API, or in combination with our risk analysis software which enables you to cover all the tenant screening process including connection to the credit bureau. We have also combined SRS with the pre-existing risk policies of our clients to ensure a smooth transition.

Our pricing model is per transaction, and we aim at avoiding any upfront costs so that we can provide our clients with the highest flexibility.

In conclusion, we can quickly deliver a significant reduction in operating costs through automation, higher certainty through lower default rates, and a competitive advantage through improved customer and employee experiences.